O U R S O L U T I O N S

Parametric-as-a-Service

Empowering (re)insurers to protect nature and create a sustainable future.

We are building the world’s first parametric insurance platform for natural capital markets.

Parametric insurance is an alternative risk solution that uses a measurable index based on predefined triggers or payout mechanisms that don’t require notification of physical damage, unlike traditional property damage cover. The benefit of parametric insurance is a faster payout for those who need it the most, and coverage is often sold alongside conventional policies.

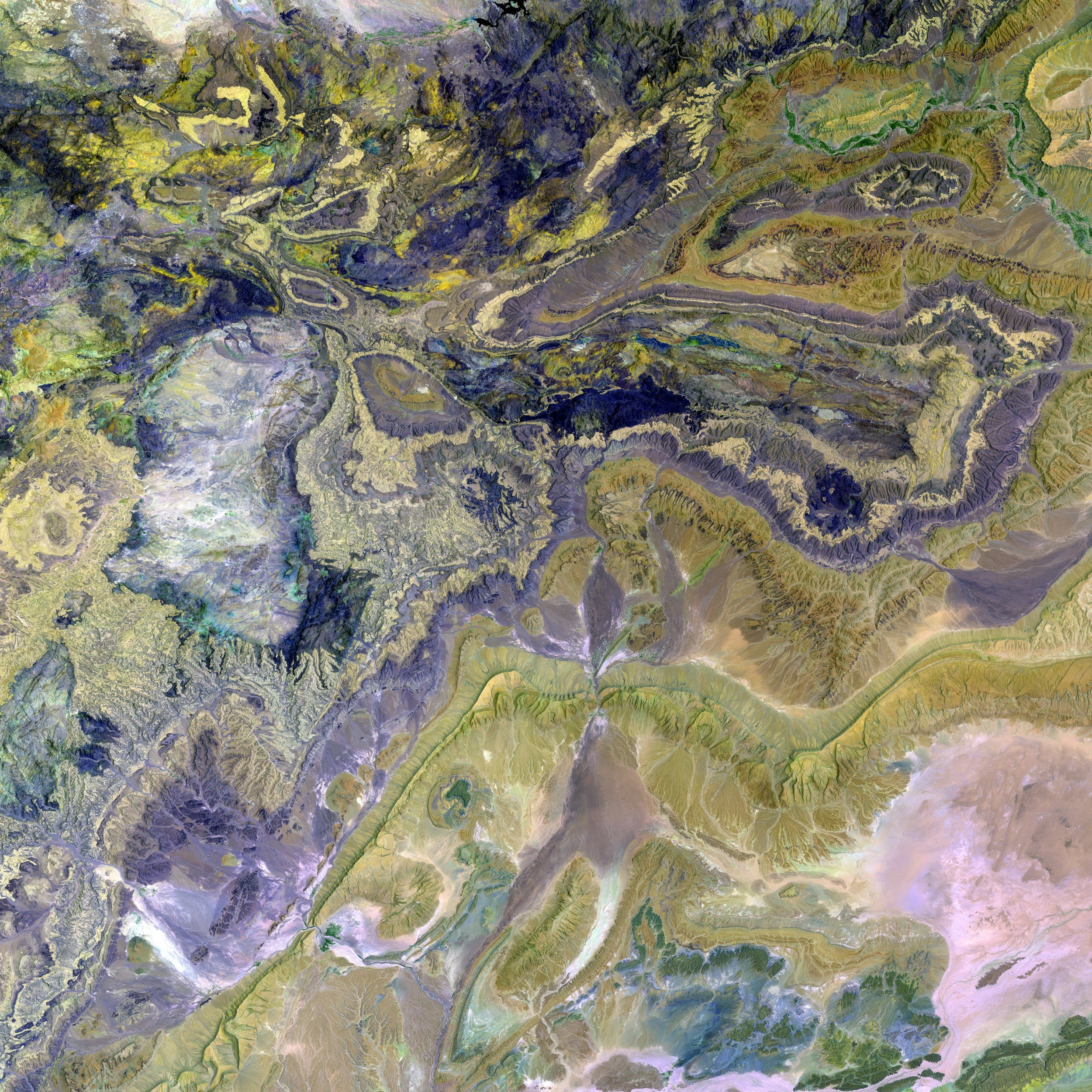

Utilizing Machine Learning and real-time monitoring from satellite imagery & IoT, our state-of-the-art technology helps businesses bounce back faster against climate, taking a nature-based approach to Disaster Risk Reduction (DRR), protecting nature, people and the planet.

NatureX RMS offers Parametric as-a-Service for Nature-based-Solutions Insurance

Build

Generate new GWP in a fast growing nature markets

Quote

Scalable offering with seamless integration without costly IT build

Operate

Flexible & transparent parametric solutions enabling new product dev to match customer needs

P A R A M E T R I C M O D E L

Accelerate transition to a green future and deliver sustainability goals

We integrate nature into risk science and insurance.

R E G E N E R A T I V E A G R I C U L T U R E I N T H E U K & U S

We are piloting our parametric insurtech platform in regenerative agriculture markets in the UK & US with an insurance broker and a food captive group that seeks to achieve regenerative sourcing and Scope 3 emissions targets.

P I L O T P R O J E C T S

Read more about our use cases below or reach out to discuss your nature-based solution use case.

-

Wildfire Resilience Insurance

-

Regenerative Agriculture Transition

Agrifood businesses looking to support growers in their supply chain to increase the sustainability and resilience of their operations achieve regenerative sourcing and emission targets.

-

Coastal Resilience Insurance

For those in high-risk areas looking to protect Coral Reefs, Mangrove Forests, Salt Marshes